In Malaysia, Sales and Service Tax(SST) was officially re-introduced on 1 September 2018, replacing the former three-year-old Goods and Services Tax (GST) system. This guide covers everything you need to know about Sales and Service Tax in Malaysia as a small business owner.

Even though SST is not the same as GST in various aspects, there are still many similarities. Despite these similarities, one main difference lies in the number of goods or products exempted via sales and service tax(SST) is more than those exempted through GST.

SST(Sales and Service Tax) is comprised of two components.,

The first is the service tax to be levied and paid in conjunction with taxable services provided in and supported by any taxable individual in Malaysia.

The second is the sales tax levied on manufactured & locally produced goods, either to be imposed during the purchase of goods or at the time of the goods' disposal or sales.

Here is provided a chronology of events that lead to SST implementation beginning on 1 September 2018

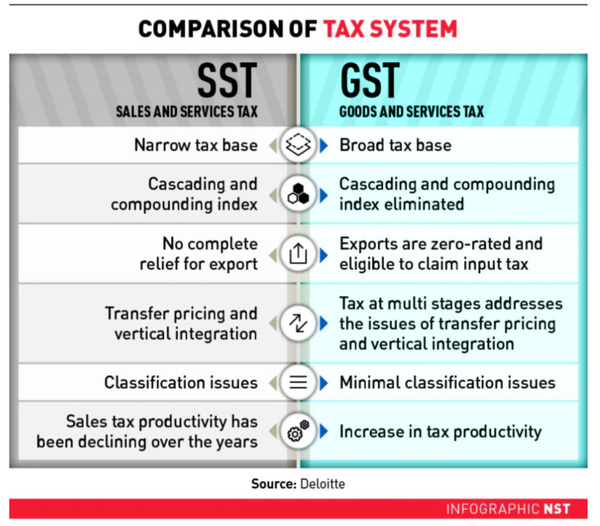

Please refer to the table below for a comparison of two tax system:

SST(Sales and Service Tax) consists of two separate taxes: the sales tax and the other one, the service tax

Sales Tax

How does sales tax works?

Service Tax

Refer to the Service Tax Threshold Table for more information.

How does service tax works?

Sales Tax @ 5%

Products charged with a tax rate of 5% are petroleum oils, construction materials, timepieces, cod liver oil, telecommunications, foodstuffs, IT, and printing materials and hardware. The tax rate for petroleum and oil are subject to high quantity-based rates.

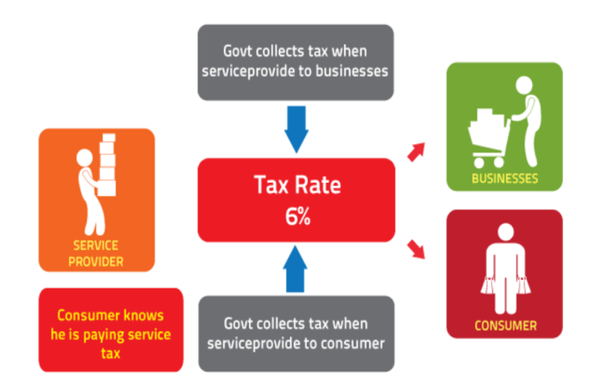

Service Tax @ 6%

The services include car hire, accommodation, hotel, repair rental, domestic flight, insurance, restaurants, electricity, legal accounting, telecoms, business consulting services, and digital supplies. Please note that services that are imported and exported are exempted.

However, digital services provided but foreigners to consumers in Malaysia exceeding RM 500,000 per year will have to register for Service Tax from the start of 1 January 2020.

Sales Tax @ 10%

On any taxable goods and imported taxable goods in Malaysia, a single-stage sales tax is charged by the registered manufacturers. In Malaysia she sales tax charged at 10% is the default sales tax rate.

Zero-rated

The main difference between zero-rated and exempted goods is that the zero-rated are taxable supplies taxed at the SST 0% rate, whereas exempted goods are non-taxable and not subject to SST.

For any listed products as zero-supplies, the company can claim an input tax credit for the materials used to build the supplies. Examples of zero-rated supplies are raw food, sugar, water, and utilities.

The businesses that perform their activities in Malaysia and internationally will have to pay SST if they exceed a particular annual income threshold. The current threshold is set at an amount of RM500,000.

The threshold for operators of restaurants, cafes, bars, canteens, or any food and beverage business is subject to RM 1,500,000.

The businesses already registered with the GST don't need to register again for SST(Sales and Service Tax). Their data will be transferred to create the SST Malaysia registration. The overall registration process is straightforward as it is an online procedure.

A tariff code is a code where each product is tagged that is involved in global trading. It is a product-specific code, as stated in the Harmonised System(HS) maintained by the World Customs Organisation(WCO).

For tax purposes, the tariff codes are required on all official shipping documents to ensure a worldwide product classification uniform.

The complete tariff code length is no less than six digits and can be up to ten also. When there are more digits in a tariff code string, the more specific it identifies the product. In the HS (Harmonised System), a series of fewer than six digits is considered a partial tariff code representing a broad category of product or chapter.

Click here to get the Tariff codes as per product classification.

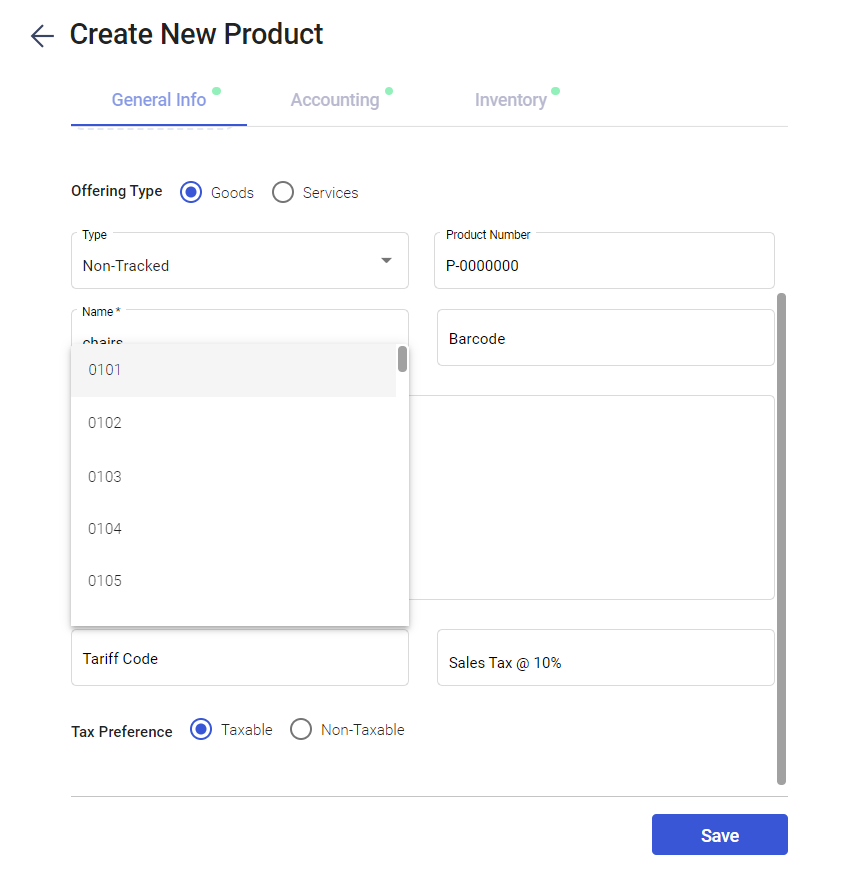

In Deskera Books, while creating a new product, you need to fill in the fields as shown, especially the tariff code, default tax rate if your products are taxable. If your products are non-taxable, indicate the exemption reason.

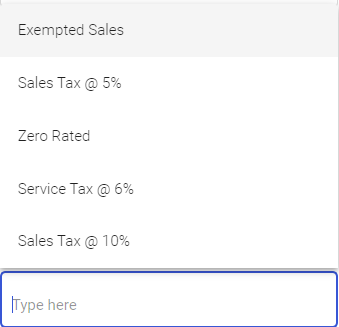

Users will have to indicate the right tariff code here, and the tax rate will be auto-populated. If you click on the dropdown arrow on the tax rate column, you will see different options such as:

Goods Exempted from Sales Tax

All goods that are manufactured for export will be exempt from sales tax.

Following are the other goods exempted from sales tax:

Persons Exempted from Sales Tax

Under Malaysia's Sales Tax Exemption Guidelines, persons/manufacturers are exempted from paying sales tax on import and purchasing locally manufactured goods.

The following persons are exempted from Sales Tax:

Schedule A

A person exempted from tax payment Schedule A is the Yang di Pertuan Agong, Ruler of States, Federal or State Government Department, Local Authority, Duty-Free Shops, Public Higher Education Institution, etc.

Schedule B

A person exempted from tax payment under Schedule B is a manufacturer of specific non-taxable goods, tax exemption on the acquisition of raw materials, components, packaging materials, and manufacturing aids to be used solely and directly in manufacturing activities.

Schedule C

A person exempted from tax payment under Schedule C is a registered manufacturer of taxable goods, tax Exempt on acquiring raw materials, components, packaging materials, and manufacturing aids to be used solely and directly to manufacture taxable goods.

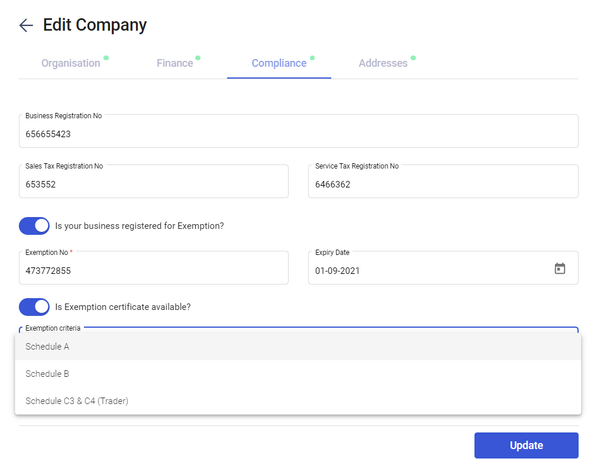

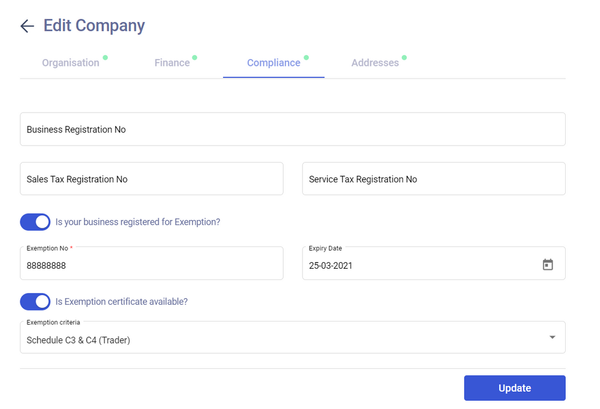

In Deskera Books, you're required to indicate if your business is registered for exemption when you're creating a new organization.

If yes, you'll have to provide the exemption number, expiry date and indicate the exemption criteria that apply to you. Indicating the right exemption criteria enables our system to generate an accurate Report in compliance.

To know about the sales and service tax(SST) regime, please refer to below regulations, orders, and industry guidelines release by RMCD(Royal Malaysian Customs Department):

In Malaysia, before applying for the SST(Sales and Service Tax), every business performing its activities must assess if they are subject to this tax. For already GST registered manufacturers, businesses, and service providers, they are automatically identified and registered under the Sales and Service Tax(SST).

These businesses may charge sales and service tax(SST) to their suitable customers. The accountant partner or firm must advise the business if they have failed to register with the Sales and Service Tax (SST) automatically. With this, the business can register itself via the MySST system.

The businesses must meet a few criteria to be liable to register for Sales and Service Tax(SST).

Sales Tax

Service tax

Following are the SST exempted business and services providers,

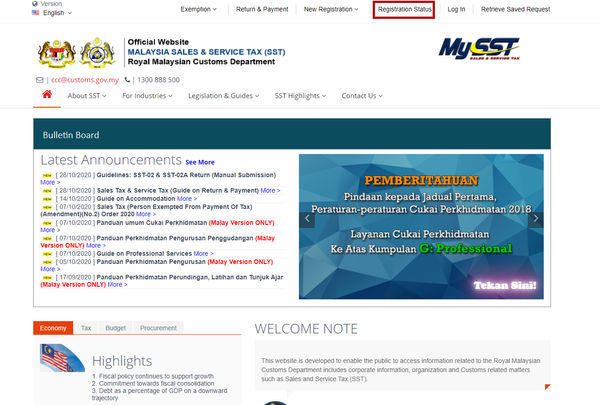

To check whether your business is registered with the SST is quite simple.

Here is the step by step guide to check SST status,

Step 1: Firstly, you need to visit its official MySSTwebsite.(https: //www.mysst.customs.gov.my/).

Then click on the "Registration Status" tab, which will open a new page.

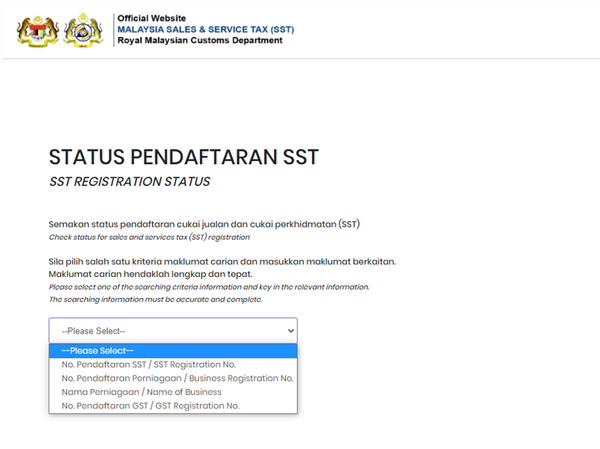

Step 2: Click on the "please select" button. With this, you will be provided with different options. Just choose the options from the dropdown list.

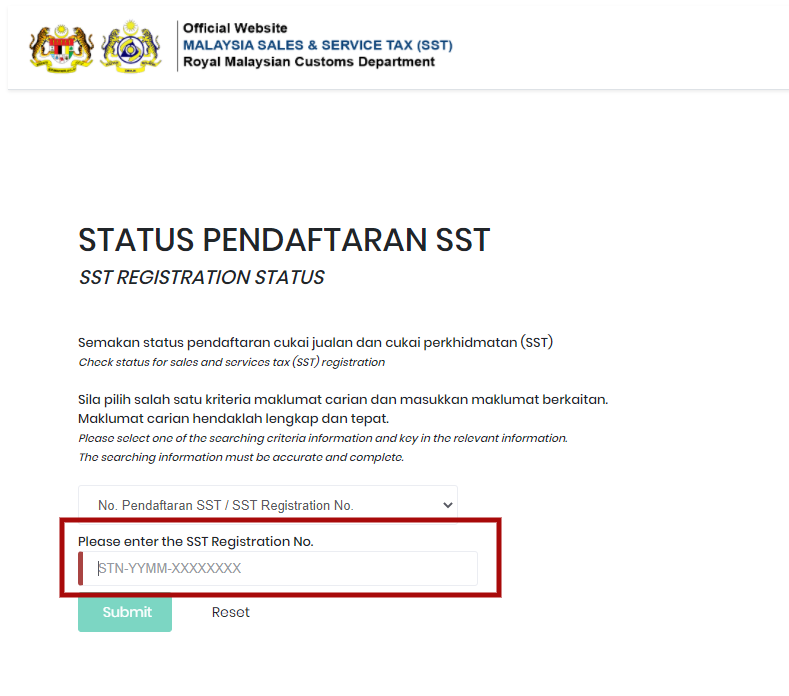

Step 3: Lastly, enter the name of your business registration number and hit the submit button.

Following these simple steps, you can easily find your SST Number and check if you are already registered with the SST through the MySST web portal.

With Deskera Books, you have an option to enter your SST registration number when creating your organization.

In the compliance section, when creating a new company, you're required to enter your business registration number, the sales tax registration number, or service tax registration number.

Indicate if your company is eligible for the exemption, and lastly, select the exemption reason. Save the record of the company details.

Responsibilities of the registered person include:

(i). Charge service tax on their taxable service

(ii). Issue invoices in the national language or English language.

(iii). Submit SST-02 returns and payment.

(iv). Keep adequate records for seven (7) years from the latest date to which the records relate.

Suppose your business is eligible to register for Sales and Service Tax(SST); you are required to complete the Sales Tax registration process or Service Tax registration process respectively through the online portal on the MySST website.

From the concerned authorities, these business owners will receive a letter/email notifying them that they are now liable to pay under the SST(Sales and Service Tax) system. The Malaysia SST registration or application process is carried out online via the MySST portal.

The application processed through this system for GST registrants is auto-approved within 24 hours. However, it may also take longer than expected if the system is required some verification for completing the registration process.

The business can apply for voluntary registration, even if it is exempt from the Sales and Service Tax(SST). These businesses should be manufacturing taxable goods, and their annual income shall stay below the taxable income threshold.

The SST registration due date will be the last day of the month, following the month in which the total sales amount has exceeded or is expected to exceed the threshold.

For Example:

29 February 2020

Total sales value of taxable goods or services exceeds the threshold

Last day to apply for registration

Effective date of registration

Please refer to this video to help you register for SST

For sales and service tax, the timing to account for the separate transactions is different.

The taxable goods are disposed of, solid, or first used by the taxable person for sales tax.

For service tax, it is when the taxable services rendered payment is received. But within 12 months, if the payment for service is not received from the date of invoice issuance, the tax will be due on the day immediately after the expiry of the 12 months.

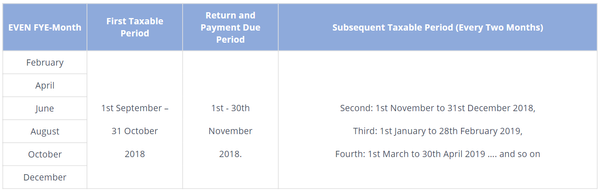

Please note two different taxable periods under your sales and service tax registration according to your FYE month; they can be odd FYE month or even FYE month.

A) ODD FYE Month= First Taxable Period = 1 month

B) EVEN FYE Months – 1st – First Taxable Period = 2 month

There are two ways to file the SST return:

As same as the filing of SST return, there are two ways to make the SST payment:

However, for payment of taxes online, there is an allowable payment limit for online transactions:

i) For corporate bank account payments (B2B), the amount is RM100 million.

ii) For individual bank account payments (B2C), the amount is RM100,000.

A partial payment can be made by cheque or bank draft and posted to the Customs Processing Center (CPC).

Penalties are imposed for the following offenses:

Failure to File SST Returns

For not filing SST returns, the taxable person is fined for

Failure to Make SST Payment

For not making SST payment, the taxable person is fined for

Please note that the failure to make SST payments and failure to make SST returns are two separate and distinct offenses.

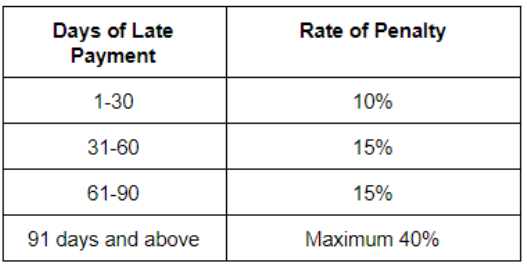

Late Payment Penalty

Please note the date when you should file your sales tax as a penalty will be charged to you for late payment.

The below table shows the rate of penalty charged for different ranges of late payments.

Evasion of tax

Using Deskera Books, you are able to generate below Tax reports for Malaysia

SST02 Report:

If you are a registered taxable person in Malaysia, you are required to prepare and file the SST-02 Report.

Using Deskera Books, you can view this report, go to the Report tab on the sidebar menu, and select the SST-02 Report under the Tax section.

SST02 Report - Part B1

Under section B1, you’ll come across the invoice document number, tariff code of the products, the value of taxable goods sold, the value of goods for own use, and the value of taxable services. The amount in each column is auto-populated based on the invoices you have created in the Sell tab.

Part B2

The line item on Part B2 is auto-populated based on the business activities you have performed on Deskera Books. Below are the explanations of each line item in the SST-02 Report:

Part D: Sales/ Services Exempted From Tax

Line 18: Sales of Taxable Goods Exempted From tax under Sales Tax (Goods Exempted From Sales Tax) Order 2018: The total value of sales tax exempted from tax in the Export/Special Area/ Designated Area and local sales exempted under Schedule A, B, and C.

Part E: Purchase Under Schedule C, Sales Tax (Person Exempted From Payment of Sales Tax) Order 2018

Part F

Under Section F, fill in the details as stated below:

Once you have generated the SST-02 Report, you will have to file the report manually by posting it to the Customs Processing Center (CPC) or submit the report via MySST Portal. Do note that the SST-02 Report should be furnished even though there is no tax to be paid (NIL Return).

Sales and Service Tax Return Report

With Deskera Books software, users are not required to prepare the sales and service tax return report manually.

For all the selling activities you have performed in the Sell tab, the data will automatically be mapped to the Sales and Service Tax Return Report.

Once you click on the Sales Tax Return, in this report, you can view the products that are sold to your customers based on the tariff code.

Besides viewing the Sales Tax Return, users can also view the Service Tax Return Report if they're in the service industry. Based on this report, the service type column shows the tariff code of the service they're providing.

Deskera Books ensures that your SST(Sales and Service Tax) and tax submissions to the Royal Malaysian Customs Department (RMCD) are easy and accurate. You can generate the SST-02 Report effortlessly and ensure correct filling of the report to the Customs Processing Center (CPC) or submitting the report via MySST Portal.

Have you ever wondered how businesses meticulously track their inventory and maintain accurate financial records? Inventory accounting is the cornerstone…

25 min read Jul 15, 2024

Salvage value is a critical concept in accounting and financial planning, representing the estimated residual value of an asset at…

11 min read Jun 12, 2024

Not all assets that a business owns are held for sale [https://www.deskera.com/blog/what-is-sales/]. Property, buildings, equipment,…

19 min read Jun 11, 2024Hey 👋! Discover the best! Now!

Get Accounting, CRM & Payroll in one integrated package with Deskera All-in-One.

Hey 👋! Discover the best! Now!

Get Accounting, CRM & Payroll in one integrated package with Deskera All-in-One.